Date: 27 April, 2023 - Uncategorized

“We are witnessing a great changeover, we are experiencing the end of abundance, the end of carelessness”.

E. Macron, August 2022

Great Moderation was – accidentally – flamboyant. During last decades, industrialized countries enjoyed decent growth, little inflation and quasi-no macro volatility. The 21st century featured the apogee but also the epilogue of the neoliberal model pushed to its limits.

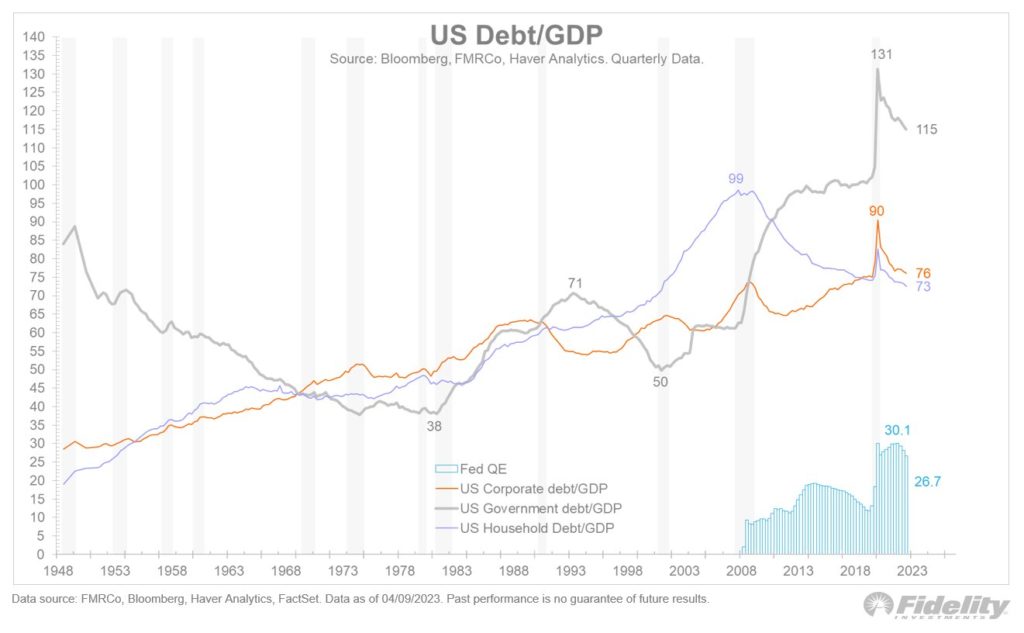

With the benefits of hindsight, we know that financialization and hyper-active monetary policies failed to deliver societal health, prosperity, and collective well-being. Worse, it encouraged inequality and debt and diverted capital from productive investment.

Two successive shocks, pandemic and Ukraine war, fueled the transition

Solving the geo-political, social, economic, and environmental challenges, requires a new Vision

Banking system, the epicenter of the system, is getting obsolete

Large Credit Card companies and emergence of a parallel P2P blockchain (DeFi) had already challenged traditional business models of banks in past years. More deviously, the broad adoption of E-/Mobile Banking by customers has spelled a new Paradigm. Clients can move deposits at a mouse click. This proved painless in the age of free money. But now… Lately other new-Comers, not the least of like Apple, decided to compete for capturing retail investors’ saving.

Such a Darwinian process should not be alarming in itself. But still, the root causes of the latest banking accidents also result from the failure (obsolescence?) of regulation / oversight. In recent years, the Fed has practically lost control of relatively small banks and Swiss Finma has failed to address the long-standing problems of Credit Suisse.

Hopefully the latest opportune risk-fencing of deposits’ hemorrhage in the US is providing a short-term relief. The odds of an imminent banking crisis have receded.

CoCos’ market message: CS fallout was idiosyncratic

But the new wave of financial engineering of the US authorities won’t address the fundamental issue. Lots of US small / regional banks are under-scrutinized, highly concentrated on their lending portfolios and often too dependent of growingly volatile depositors. Granted, none is systemic, but altogether they namely represent the lion-share of the funding of the US Commercial Real Estate and car-leasing markets!

The Fed’s method of intervention is reminiscent of the old neoliberal methodology: first provide liquidity at profusion (through Discount Window and Bank Term Funding Program). Then, don’t hesitate to circumvent the (accounting) rules: the loans granted by the BTFP, and discount window schemes mask the (unrealized) losses of the banks by temporarily plugging the holes in their balance sheets. This carry trade of the Fed – whose balance sheet has incidentally been deeply damaged by… the same unrealized losses (!) on Treasury bonds – renders the action of private rating agencies Cornelian, if not impossible.

Fed is doubling down on QE/T losses by loading more downgraded bonds at par value

Normalization of policy is tentative and insufficient

Being too loose for much too long still have some advantages. Fed and ECB managed to restore inflation, which is ultimately less of an evil than … (debt) deflation. The attempted normalization of monetary policy also represents a major virtuous change in economic agents’ mindset:

- End of Financial Repression / ZIRP spells lower propensity to raise debt / speculate

- Restauration of positive real rates will ultimately spell a higher propensity to invest capital in productive factors

Still, liquidity addicted markets dislike / convulse at QT. While nominal policy rates have actually quit the abnormal zone, downsizing the Fed balance sheet remains wishful thinking. We may well rather reinstall QE to address a collapse of activity later in the year.

A comprehensive rehearsal of the macro-prudential landscape is urgent but unlikely. Doing it would spell blaming the regulators responsible for the debacles, as well as the politicians who set the legal framework to allow for it. This is totally unimaginable. Things could maybe change after the 2024 Presidential elections, depending on their results. Unless other major financial accidents occur before then, requiring the designation of scapegoat(s). Tighter supervision of small US banks is likely to come. As well as perhaps an increase in the limit for insurance on bank customers’ deposits. These two political initiatives will not solve the root of the problem.

Burgeoning crisis have not proved dramatic enough to trigger a rapid change in policies

A – not very likely – debt ceiling impasse could accelerate the pace of policy restructuring

A new consciousness in the making, for new paths?

Anecdotal evidence abound that the world is profoundly changing.

Nationalism and security concern take over. Hence the voted US chips / inflation / re-onshoring Programs. The UE is also setting up ambitious plans for energy transition. Scandinavian countries, neutral since the post-war period, switch and join NATO. Australia and Japan are actively re-arming, if not moving Nuke.

The appropriation of the Russian central bank’s assets and the blocking of oligarchs’ accounts set precedents resulting in palpable legal uncertainty among Southern or ¨non-aligned¨ countries. Swiss policymakers mobilized in a week-end, going so far as to putting at risks the sacrosanct Rule of Law principles.

Before the Council of Foreign Relations in mid-April in New York, Mrs. Lagarde surprised by her lecture with freedom of tone. She spoke openly about the new imperatives of central bankers. For her, the transition to a ¨war economy¨ will result in:

- less independence / more coordination between central banks (of the same bloc)

- Eurobonds

- digital central bank currencies

She more implicitly evokes the inevitable rise in structural inflation, hence:

- an upcoming (upward) revision of central banks’ inflation targets

High Nominal GDP growth (like 2021-2) is required to push down Debt to GDP

The world is changing before our eyes in a structural way

- A negotiated solution between Russia and Ukraine would not interrupt this secular evolution

- Industrialized countries have no choice but to tame interest rates

- Central banks will lose independence and obliged to adopt higher inflation targets

- Macro-prudential / supervision / regulatory framework need a reset to ensure Financial Stability

- Cross-asset correlations will be unstable and markets more volatile than in past decades

- Delivering solid risk-adjusted performance next years will require

- less of tactical allocation and trend following skills

- more capacities to think outside the box: challenge benchmarks, revisit strategic asset allocation and re-shape investable universe