Date: 29 July, 2019 - Blog

The automotive sector is going through a difficult period, both stock market and industrial

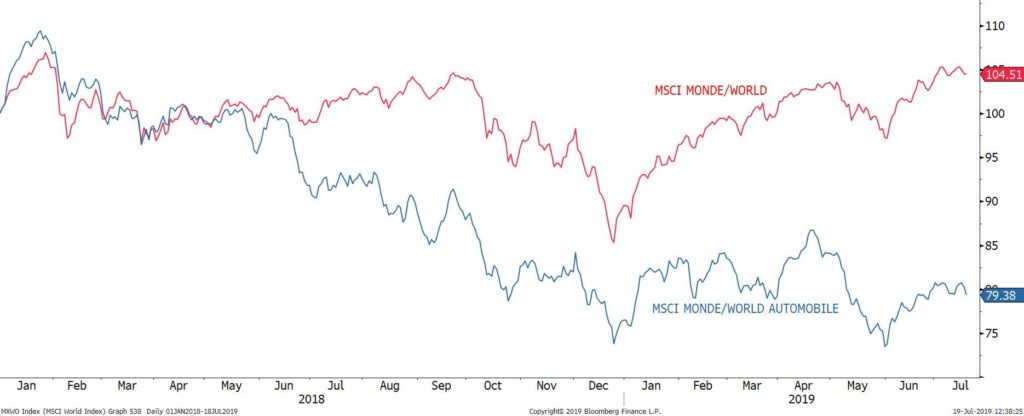

The sector significantly underperforms the overall index and has the worst sector performances.

Performance (base 100) MSCI World and MSCI World Automobile since 2018

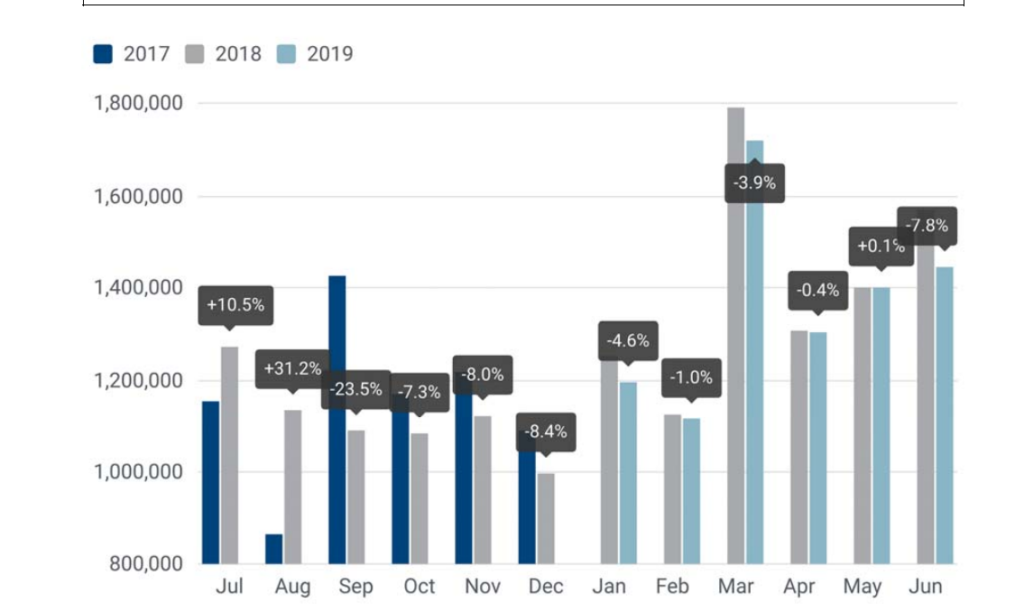

Global sales began to decline in September 2018, when the new WLTP standard (CO2 test) came into effect. Apart from Brazil and Japan, the global market is in a recession with sales down 6.6% in the first half of 2019.

In Europe, they fell 7.8% in June and 3.1% in the first half of 2019, a depressed trend that began in September 2018.

New passenger car registrations in the European Union

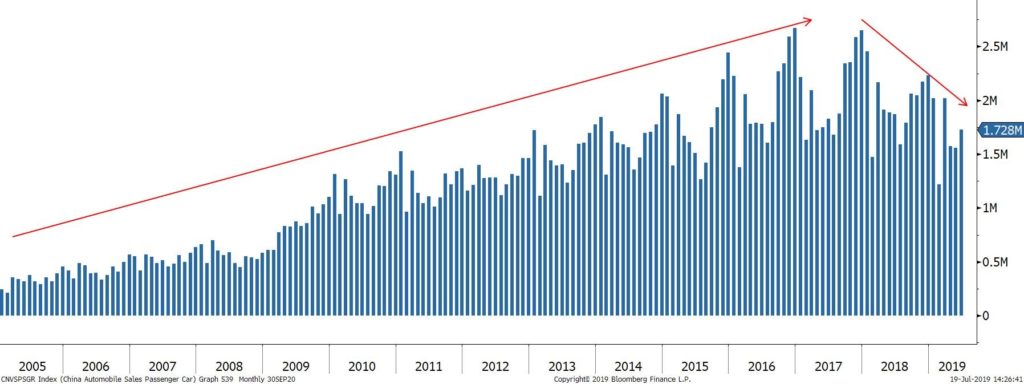

In China, the situation is even more worrying with sales down 12.4% in the first half 2019. In 2018, registrations fell for the first time in 30 years. SAIC, the largest Chinese manufacturer, which has Volkswagen and GM as partners, expects a 7% drop in sales in 2019, the first in a long time, the main reasons being the technological changes and the economic slowdown.

The situation in China could have been worse if the manufacturers had not made large discounts to reduce inventory and support sales. The year 2019 is also penalized by the elimination of a tax incentive for the purchase of cars implemented in 2018.

China. Monthly sales of passenger cars in units. Decline since 2018: 24.7 million in 2017 (peak of the cycle) and 23.7 million in 2018. In 2018: United States 17.5 million cars sold and Europe 15.6 million

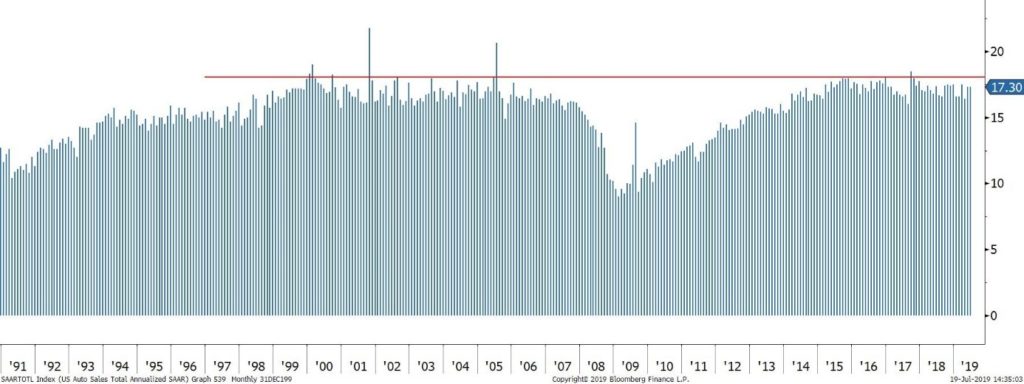

United States. Annualized monthly sales. The 17.5 million / year seems an impassable level. 2.4% decrease in sales in the first half of 2019

Worldwide harmonized Light Vehicle Test (WLTP) standards have several consequences:

1) higher CO2 emissions, increasing the malus on petrol / diesel cars, 2) introducing new engines or reducing the power of certain engines, 4) updating certain engines, affecting the production lines, and increasing delivery times.

The European sector has undergone partial and total bans, effective or announced, of the circulation of diesel cars in the biggest European cities, a trend that will continue until 2025. Consumers have refrained from buying diesel cars. A recent survey shows that 70% of motorists who switched from diesel to gasoline in the last three years regret their choice because of excessive fuel consumption. But returning on diesel is complicated, since diesel is no longer welcome in major European cities. In Europe, the share of diesel has declined from 52% in 2015 to 36% in 2018.

There is of course also the technological and ecological transition towards electric cars

For the consumer, this type of car is still too expensive, their autonomy insufficient and charging infrastructure difficult to access. For manufacturers, the business model needs to change, and research and development costs are exploding, which is why we are witnessing an acceleration of partnerships in the electrical sector.

We do not really believe in mergers between traditional groups, because that would be merging two old business models. The traditional groups have to get closer to expertise in the electrical field and in technology (autonomy and connectivity), and in this last expertise, we will witness major upheavals among the automotive suppliers.

In the electrical sector, Chinese manufacturers could become great competitors because the Chinese control a large part of the world’s battery production capacity and essential raw materials such as cobalt and lithium.

To complicate matters, technology giants such as Google, Apple, Amazon, Alibaba and a few others will be disruptors, their cash helping, participating in the electrification, autonomy of the means of transport, as well as to connectivity. Their flexible business models will easily contrast with the less flexible business models of traditional automakers.

- For the various reasons explained above, fears of a large slump in sales between 2019 and 2021 appear to be materializing