Date: 9 January, 2020 - Blog

Finally, a – trade – truce

The upcoming signature of a ¨phase 1 deal¨ between the US and China is good news. It will eventually spell the de-escalation of last two years’ trade war. It practically will mean a gradual unravelling of the ¨corrosive¨ tariffs imposed by Trump last Q2/3 2019, which – if implemented – would have nastily cascaded up to US consumers. Considering the late stage of the business cycle, such a burden would have provoked undesirable consequences.

It remains important to figure out the actual perimeter and nature of this deal. Indeed, Chinese purchases of US agriculture and other goods seem guaranteed. It also seems that Xi will ¨concede¨ on the currency front, i.e. stabilize the Yuan. Additional opening-up of the Chinese financial services might also take place. But for the rest of the pact, the jury is still out as of today!

Vanishing trade tensions should somewhat unleash capex / investment

But this will not be enough to restore a global trade buoyancy

However, trust is not restored

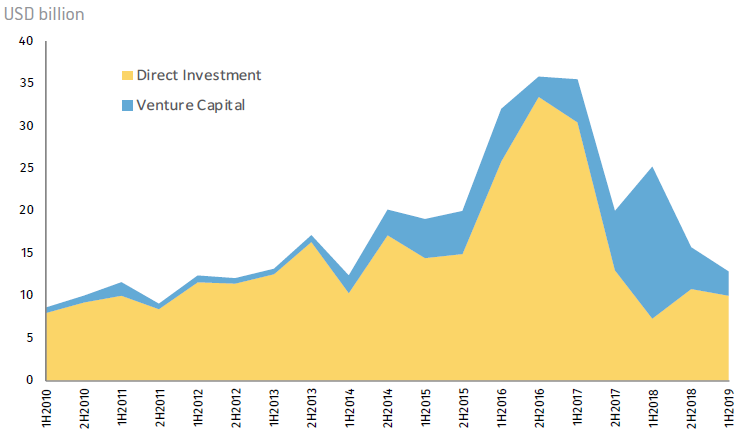

The US has been hastily erecting law and barriers against unfriendly foreign investments for a couple of years now. The most consequential actions were taken against ZTE and Huawei. Logically, Chinese capital flows reversed from their top in 2016. A sharp slowdown is visible in M&A, Direct Investments and venture capital.

Total Chinese investments into the US

Source: Rhodium Group

Both government bureaucracies are going ahead with measures to curb what it sees as increasingly serious security risks from the other side. The drive to achieve at least a partial decoupling of the US and Chinese economies is particularly focused on technology. China is accelerating its restrictive security regulations on IT hardware, software and data flows. China’s Cybersecurity Law, which came into effect in June 2017, is the legal foundation for current efforts to achieve these goals.

Chinese inflows will continue decelerating

US M&A may be due for a cycle-end deceleration

The costs of doing business in China for foreign companies will rise

Arbitration and enforcement, the ultimate grains of sand

China’s accession to the WTO in 2001 fueled the set-up of a global and common level-playing field on trade’s (legal) framework. As a main beneficiary of globalization, Beijing has clearly become a growingly ardent advocate of Free Trade. As a corollary, international commercial arbitration has flourished, in line with the continuing development of cross-border trade and investment.

Ultimately, any court ruling in a specific country (US), region (Europe) or by a supranational organization (say WTO), should theoretically be a) acknowledged for and b) implemented by the concerned counterpart (say China). In practice, this is far from being the case yet. The growing mistrust of Trump administration for multilateral entities and processes has proved a (new) dampening factor.

Up to recently, the failure to sign a durable trade pact between Washington and Beijing was namely due to the US, attempting to impose US / Western system and courts for any dispute, where-ever it happened… Now, new discussions and explorations are underway regarding international arbitration, such as investor-state arbitration and third-party funding.

When it comes to enforcement, China made efforts in recent years to be align with internationally acceptable standards. This favorable approach accelerated since 2013, in order to facilitate its Belt and Road Initiative (BRI). In pursuit of this cause, China adopted nationwide applicable measures and made groundbreaking innovations within its Pilot Free Trade Zones. But still, the inertia and proportion of rejection by Chinese administrative tribunals remain significant.

The gap is important between under-average Chinese standards and a growingly protectionist US

It will take new and significant political initiatives / brake-throughs to forge durable bilateral pacts