Date: 16 March, 2023 - Blog

Two important events marked the stock markets last week: the Fed’s reliance on economic data and the bankruptcy of the Silicon Valley Bank (SVB). The month of March should therefore be volatile, for a return to calm hoped for in April.

The Fed. Communication is not Jerome Powell’s strength. An ambiguous speech that disturbs stock markets. During his Capitol hearing, he said that the Fed Funds terminal rate should probably go higher than expected, only to backpedal a little later with more measured comments. A few days earlier, Fed officials had indicated that the Fed Funds hike was coming to an end. Inflation is decelerating, but not fast enough. The Fed will react according to economic data and of course to the evolution of inflation. The Fed is therefore becoming more than ever data dependent, which reduces investors’ visibility and increases volatility. Inflation remains too high for the Fed and maintains its objective of a return to 2%, even if it would have to create a recession.

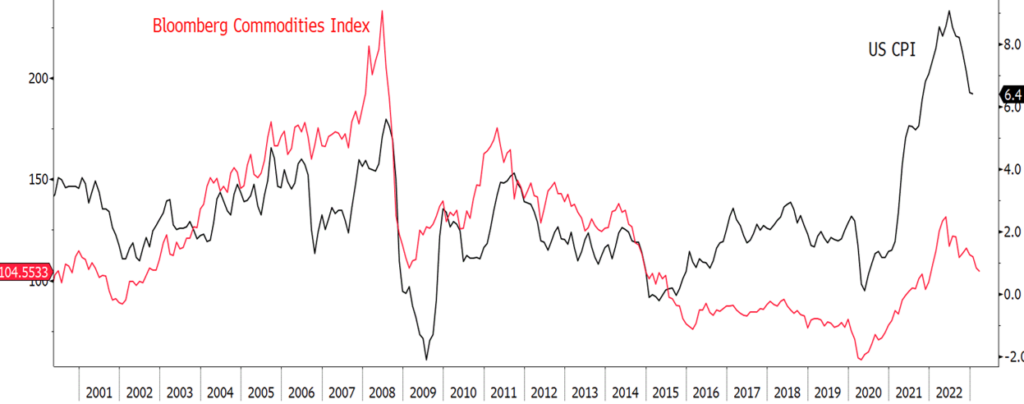

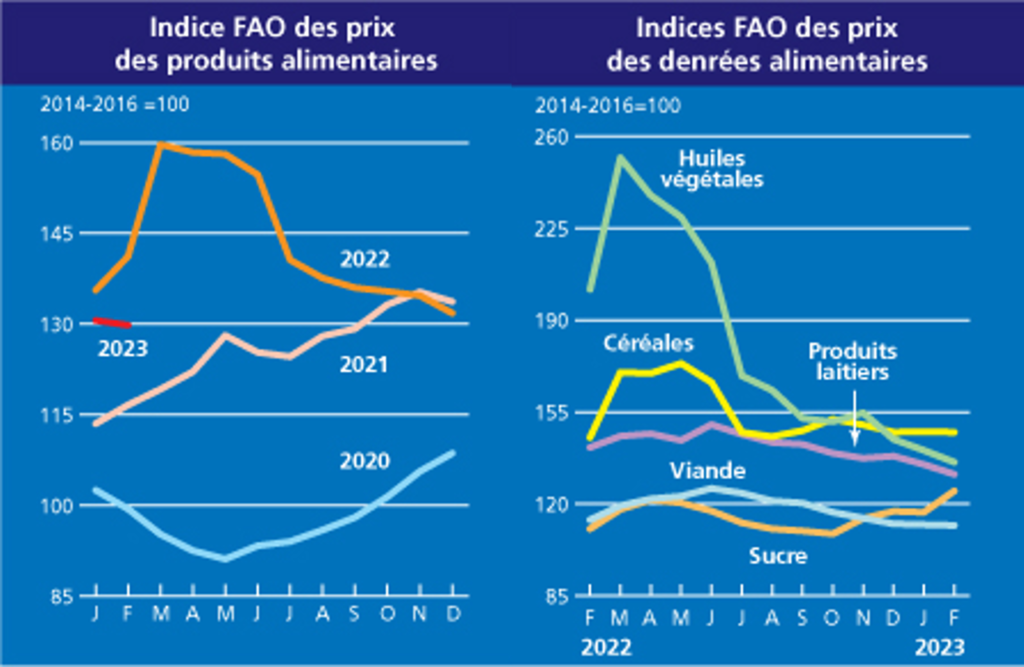

We are maintaining our scenario of a deceleration in inflation in the 1st half due to a base effect of energy prices, then food prices in the 2nd half. This should calm tensions on rates. Since their peaks, caused by Covid and the war in Ukraine, all energy and food commodity prices have fallen: Brent has fallen by 37%, gas 75%, wheat 46% and 25% corn.

US inflation and global commodity index

All the major French distributors concede pressure on food prices in the 1st half of 2023, but ensure significant declines in the 2nd half thanks to new contracts signed with manufacturers.

Silicon Valley Bank (SVB)

The rise in interest rates and the QT of the Fed reached limits. A bank, the SVB, went bankrupt. It is a medium-sized bank, located in Silicon Valley, and active in the technology sector, startups and venture capital. It was the 16th largest bank in America. After deposit outflows of $42 billion on Thursday, 25% of total deposits, and the failure of a capital raise, the California Department of Financial Protection and Innovation decided to shut down SVB and asked the FDIC – the Federal Deposit Insurance Corporation – to take care of the aftermath. Sunday evening, failing to find a buyer, the Treasury and the FDIC announced the guarantee of all deposits for all customers to avoid a stress in the banking system, in particular in the segment of small and medium banks.

SVB had important customers in technology. Roku, a world leader in set-top boxes for streaming TV, had $487 million at SVB out of a total of $1.9 billion on its balance sheet. U.S. leader Sunrun in solar panel installations saw its shares drop 13% on Friday, as SVB is a major Sunrun bank. Many other companies are affected such as Rocket Lab, Etsy, Vimeo, Circle, Roblox, BlockFi, Compass Coffee, Camp, Axsome Therapeutics, Vox Media, Slumberkins, Ambarella, Oncorus, Sangamo Therapeutics, Eiger Biopharmaceuticals, Wrapbook, Juniper Networks, Lending Club, Unity Software, iRhythm Technologies, for the first ones that appear.

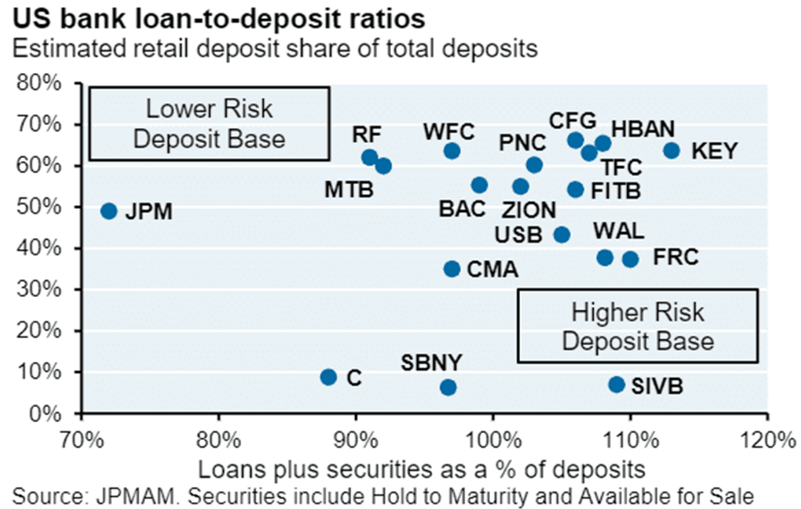

Many Silicon Valley companies had warned of possible delays in salary payments. At the end of 2022, 95% of SVB’s deposits were uninsured (the FDIC insures deposits up to $250,000), as they were collateral for clients who own startups and venture capital companies. At Bank of America, this percentage is 38%. The bankruptcy of SVB would have been more painful for customers than that of Washington Mutual in 2008. Washington Mutual had been acquired by JPMorgan Chase.

SVB had one of the riskiest profiles in the banking sector.

This weekend, many politicians, Republicans and Democrats, and the technology sector called on the federal government and the Fed to react quickly and find a buyer before the reopening of financial markets on Monday March 13th. The main concern was the loss of confidence among medium-sized banks.

Even though SVB’s risk profile was high, the shock is there. Confidence in other medium-sized banks has been called into question and we will wait to know all the collateral damage, if any.

This bankruptcy highlights the impact of rising interest rates and the difficulty for startups to raise funds, resulting in faster consumption of cash and thus reducing deposits. The decline in deposits, which are important to meet prudential banking ratios, also comes from customers who prefer to buy US Treasury offering better yields than deposit rates. Faced with these withdrawals, SVB had to sell assets, including bonds, with significant realized losses on the bond portfolio.

US Treasuries compete with deposits. This is a problem that the banks are going to have to solve by raising the deposit rate, meaning an impact on profits. According to JP Morgan, deposits in the United States have decreased by $422 billion since mid-2022. This phenomenon is observed by all analysts. The Fed’s QE had artificially increased deposits by $3 trillion and this excess liquidity will be gradually taken out of the banking system, forcing banks, which have not developed a solid customer base, to offer attractive rates on deposits.

- Two important events will bring more volatility in March: the Fed’s “data dependency” and the bankruptcy of SVB

- The deceleration of inflation in 1H23 should calm the Fed

- The bankruptcy of SVB could put in question the continuation of the QT of the Fed

- The SVB was a bank with a particular profile

- We underweight the banking sector and avoid small and medium US banks

- US banks could raise deposit rates, hurting profits

- For the moment, we are maintaining our positive view on equities for the whole of 2023