Date: 19 December, 2024 - Uncategorized

China will engage in talks amid a deteriorating economic situation. But it will not suffer from the element of surprise in Trump 2.0.

China has had plenty of time to assess and analyse the developments/ changes in the US administration

Quality expansion, at the expense of dynamic growth

The Politburo has been calling for a strategic reorientation of economic policy for several years. The reasons are both defensive and proactive. Firstly, to avoid the Japanese syndrome – i.e. the bursting of bubbles and deflation – and secondly, to climb the ladder of economic value creation, especially in the high-tech sector.

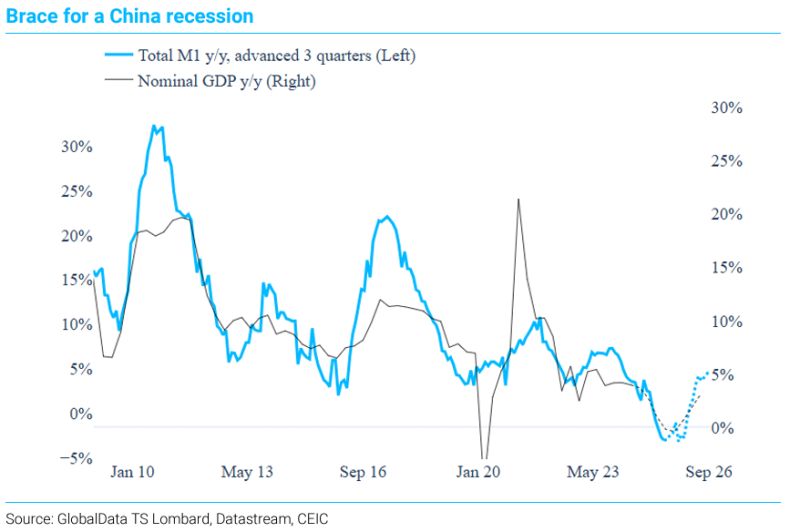

As a result, policymakers have imposed a painful deleveraging of the overleveraged private sector. The collapse in residential property activity and prices, which began in 2021 with the Evergrande default, is severely constraining domestic consumption. The country has entered a deflationary balance sheet recession.

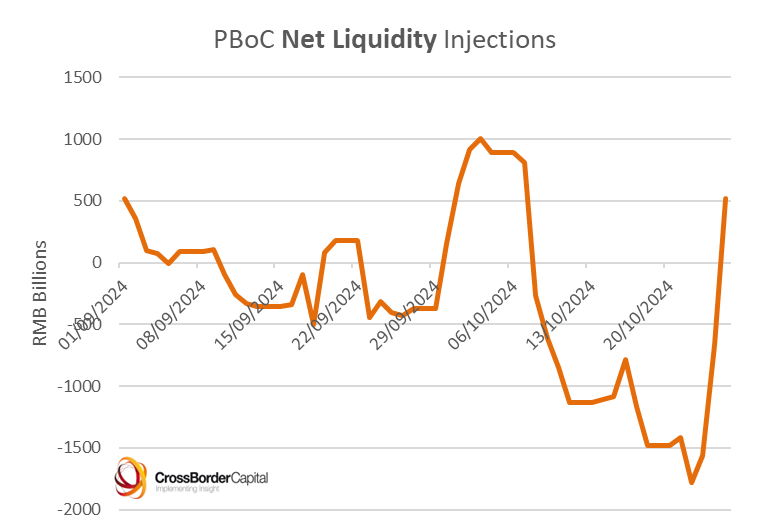

Monetary easing and financial engineering are designed to put a floor under the ailing sector. By stopping the destruction of wealth, policymakers are buying time but not solving the problem. Ultimately, the PBoC will fight deflation with QE-like measures and balance sheet growth.

In the short term, China is unlikely to launch a bold fiscal stimulus package targeting the private sector

Even so, China is determined to stabilise the situation and start the dialogue with the Trump administration

Clock is ticking as lower Chinese rates don’t spur credit growth

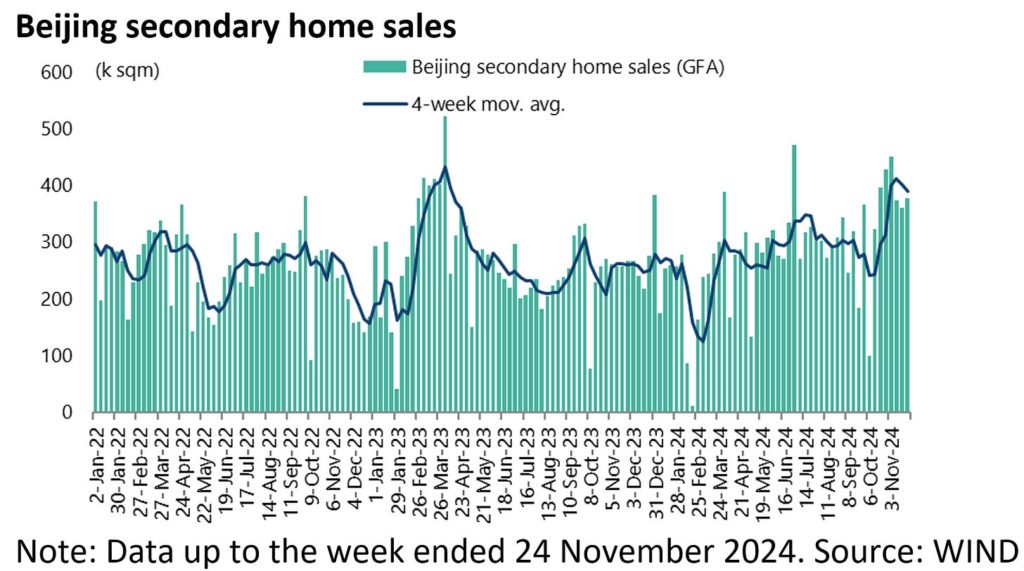

Early signs of a property market bottom

As the Chinese property market matures, activity continues to shift from the primary to the secondary market. Residential property transactions have picked up noticeably over the past two months, following the easing measures announced by Beijing at the end of September. With prices having fallen by almost 40%, buyer sentiment is showing signs of bottoming out. With the recent debt swap, Beijing has also provided additional room for manoeuvre at the local government level, in an attempt to address the issue of unpaid wages and outstanding receivables as a result of the slump in land sales.

Promoting dialogue and de-escalation, while keeping its cards close

The Yuan has remained relatively strong against its emerging market peers in recent months. The JPY’s unwanted and hectic moves have helped. However, tariffs are likely to put downward pressure again. Beijing may ultimately decide to let the currency depreciate, unlike in 2015-2017, to also defend its foreign exchange reserves. In a surprise move last month, China issued USD 2bn of sovereign bonds in Riyadh. Interestingly, this auction was heavily oversubscribed and priced at almost the same level as US Treasuries. There are many interpretations of this new initiative. Among them are that a) it confirms Saudi Arabia’s willingness to free itself from US orbit, and b) China is offering emerging markets a potential substitute for US Treasuries to park their USD trade transactions/surpluses. This clear Chinese message has been well received in the US, given Trump’s immediate threat – 100% tariffs – against countries trying to bypass the USD.

China has banned shipments of gallium, germanium, antimony and so-called superhard materials to the United States because of their “dual military and civilian use”. Exports of graphite will also come under increased scrutiny. China’s dominance in rare earths has significant implications for global technology in several ways. China’s established infrastructure and expertise make it difficult for competitors to catch up in the short term.

Xi can U-turn if the situation warrants it (i.e. Covid). If a serious trade war were to break out, they would certainly not hesitate to implement an ambitious fiscal stimulus package.

Don’t underestimate Beijing’s responsiveness. It is carefully preparing a wide range of responses to counter the Trump administration’s trade threats. Watch out for renewed momentum / volatility in Chinese assets over the next year

Net liquidity injections: PBoC has shifted gears

Normally, an increase in transactions would precede a stabilisation in prices

In 2015/16 China fought devaluation and burned $1tn fx reserves