Date: 16 May, 2022 - Blog

Democratizing finance. The ultimate elusive paradigm shift?

Paradigm shifts are often announced (¨this time is different¨) but, in reality, less often realized. This is exactly the case with the emergence of popular capitalism version 3.0, illustrated in particular by investment forums/blogs on social networks, such as Reddit. In 2020 and 2021, the popular infatuation with the financial markets was undeniable and colossal. Except that it occurred during the pandemic, a period when containment fueled its interest, particularly as a substitute for online sports betting. It was exacerbated by the generous distribution of government cheques.

Steep learning curve for new generation(s)

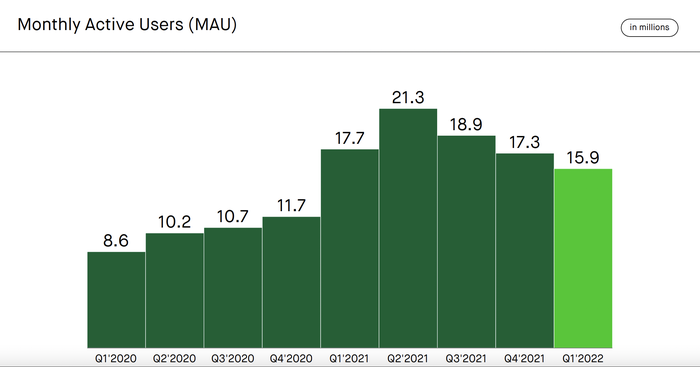

The Robinhood platform is one of the symbols of this. The object of all the praise for enabling the “democratization of trading”, it has been much criticized during some difficult stock market episodes. Its business model (free trading) and its (too) close links with certain brokers (order flow / Citadel) have been the subject of scrutiny by the stock market supervisory authorities, including the SEC. The wind is clearly blowing again. The number of users of the “generous” platform conveniently started to decline at the same time that the first (Republican) states stopped in – Q321 – the household watering / check distribution.

Robinhood is relentlessly losing monthly active users…

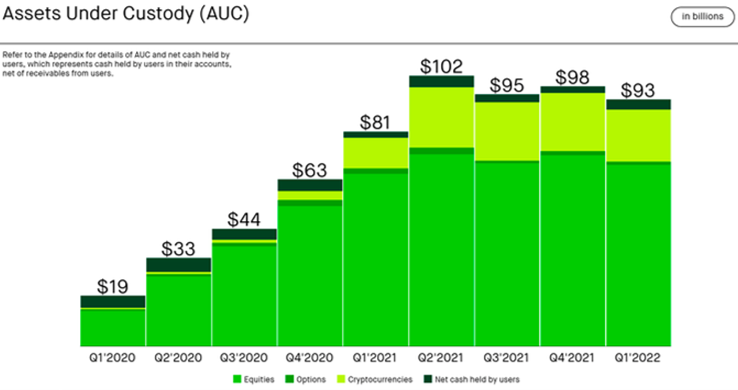

… and assets, despite new crypto activities

Source: Robinhood

The nimble platform has been trying to expand business into the crypto trading space. Growth of this segment was undeniable in 2021 but has stalled lately. At the beginning of April, Robinhood rolled out crypto wallets to the approximately two million customers on its waitlist and is on the verge of completing the full roll-out to all customers. Amazing, but… unfortunately the timing of these investments may prove ultimately poor. Indeed, the recent collapse in crypto assets/currencies also foreshadows a likely slowdown in the volume of activity for Robinhood in late 2022.

Concurrent decline in (traditional) margin trading

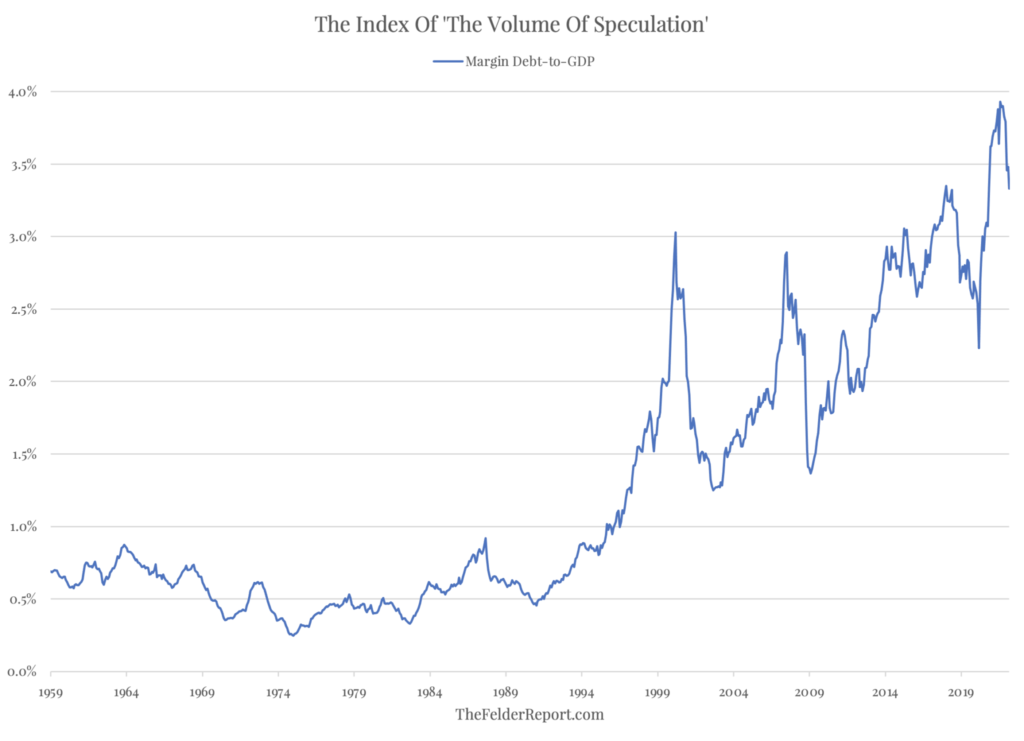

The volume of brokers’ loans, as compared to GDP, reached unprecedented level by the end of last year. This is a symptom of rampant speculation.

The index of “the volume of speculation”

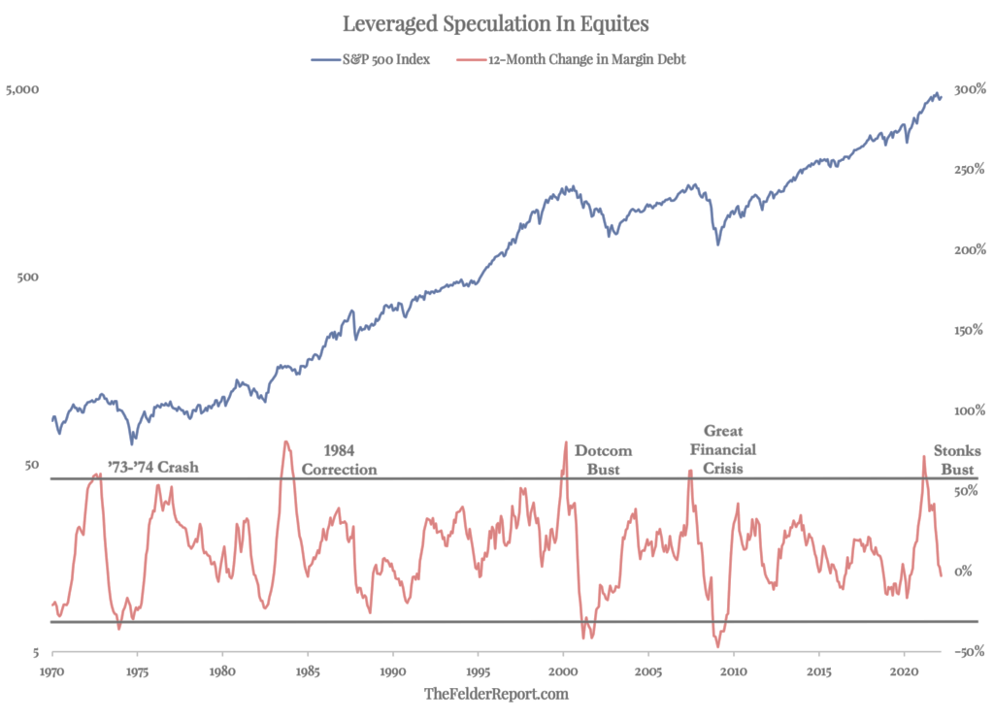

In the past, the spikes of this indicator happened just before very significant market corrections. In the past months, the rising volatility and corrective pattern of equities initiated a significant decline of margin debt. This could be an explanation – among others – of the acceleration of equities decline. Margin calls force global selling, including of most liquid assets, which result in new margin calls when specific thresholds are reached. If history is any guide, the deleveraging of – essentially retail – investors is well-advanced (see red line in the below graph). But not over yet.

Crypto-carnage – an accident waiting to happen?

In its – premonitory – Stability Report published early May, the Fed spotted specifically worsening market liquidity conditions. Its warnings were both global / contextual and specific to the crypto-sphere:

“The war has sparked large price movements and margin calls in commodities market and highlighted a potential channel through which large financial institutions could be exposed to contagion”

“Increasing use of stablecoins for levered trading in other cryptocurrencies may amplify volatility and heighten redemption risks”

Rumors abound of a possible bankruptcy of Coinbase, a large secure online platform for buying, selling, transferring, and storing cryptocurrencies. What ignited the fire earlier this week was that in its quarterly report sent to the stock exchange regulator it formally stated that the cryptos it holds on to behalf of its customers may not automatically revert to them in the event of bankruptcy. In short, Crypto´s internal plumbing, the “financial asset” backbone – is facing kind of a run on the bank. Incidentally, the company has started to delay by a few days the execution of clients’ orders… for their protection. This is reminiscent of measures taken by distressed hedge-fund / fund managers. Coinbase is a large organization, probably systemic to the whole crypto-sphere. Consequently, at least in a first phase, the cohort of crypto-supporters will attempt support it to avoid a proper bankruptcy.

Stable coins are under huge pressure too. TerraUSD the famous algorithmic stable coin just collapsed. Tether, another large actor in stable coin has been also attacked lately. It temporarily lost its indexation on the USD. Its business model is theoretically safer, as it is supposed to keep 1 to 1 collateral in plain USD cash / securities. But the company never provided transparency of the structure and proper level of this collateral… Ultimately, US regulators hold the key when it comes to the outcome of these so-called Stable Coins.

Confidence in crypto assets and stable coins vanished

In the end, the Fed-SEC may regret their delay / procrastinating in regulating crypto-assets

- Liquidity is drying up, fueling a rapid tightening of financial conditions

- It spells a disorderly de-risking of leverage investors

- At the margin, it will have some – negative – impact on retail consumption, especially the most discretionary