Date: 28 February, 2019 - Blog

In the world, there are several oils depending of the quality

There are 2 main criteria:

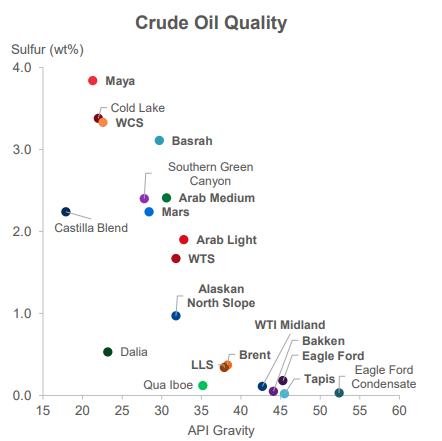

- The density (or viscosity) expressed in API. The higher the API, the lighter the oil, and the lower the API, the heavier the oil. A light oil has an API greater than 31.1, an average one between 22.3 and 31.1, and a very heavy one less than 10.

- The sulfur content, expressed as a percentage, measures the corrosivity of oil. A sweet oil has a sulfur content not exceeding 0.5%.

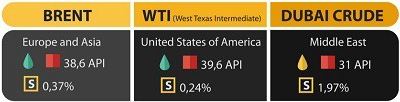

Compared to these criteria, it appears that WTI (West Texas Intermediate) and Brent Crude (North Sea) have similar characteristics, but WTI is lighter with a lower sulfur content. Dubai Light is a heavy oil with a high sulfur content. The oil from the US shale is very light with little sulfur.

Brent is the reference price for about 66% of the world’s oil, WTI is the benchmark in the United States and Dubai Light in Asia.

Today, the price gap between Brent and WTI is $10, in favor of Brent, while WTI has a superior quality. Then, WTI should pay with a premium, which was the case until 2011. See graph.

Brent (black) and WTI (red)

But the United States has a problem: the excess supply of light oil from shale production. As said before, WTI and US shale oil are light oils with little sulfur, but the major US refineries have been built to primarily use heavy oils from the Gulf of Mexico, Canada and Venezuela. So oil inventories in Cushing, coming from shale, have grown, US refiners being unable to transform it. Changing the infrastructure of US refineries is extremely expensive. In 2015, the US authorities made a historic decision by lifting the ban on exporting oil. This helped to decongest the US market and export US light oil to European refineries.

The United States has 2 options:

- modernize / adapt its refining capacity for light, but it will be very expensive. Total and Exxon Mobil have decided to spend billions to increase refining capacity of light crude oil in the United States.

- massively increase exports, which appears to be the best solution. Nevertheless, this must be accompanied by investments in the infrastructure in export oil terminals, able to accommodate mega-tankers shipping 2 million barrels.

The trend is an increase of the US oil market share worldwide and if this is confirmed, a reduction in the spread between Brent and WTI should occur. But in the short term, the gap should remain: the fall in Venezuelan and Iranian oil exports, as well as the drop in Saudi output, all of which are heavy oils, will weigh on world supply, while US light oil will continue to rise.

The United States absolutely needs Venezuelan heavy oil, the basic raw material for producing kerosene and diesel. Without this oil, the energy supremacy of the United States is undermined. In fact, the gasoline crack spread (red), which is the difference between the price of WTI and the refined product, rose again in early February, signaling that Venezuelan oil imports should resume. The market seems to anticipate an American intervention to bring down Maduro. The crack spread also estimates the profit margin of refiners: Venezuelan supply will return, while demand will accelerate as the driving season in the United States approaches.

In the US energy sector, export and infrastructure companies as well as US refiners are favored.

- We buy in the United States, Cheniere Energy (LNG), Kinder Morgan (KMI) and Valero (VLO).