Date: 20 June, 2019 - Blog

Tension is rising sharply in the Strait of Ormuz

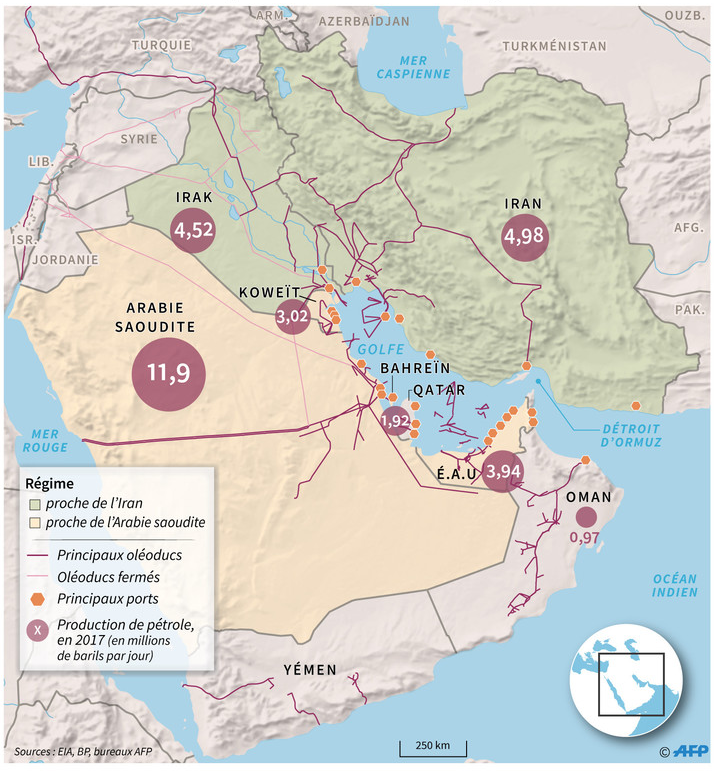

the Strait of Ormuz is a vital road for the oil market where 2,400 tankers per year pass, more than 20% of the crude consumed. Ships are attacked and oil pipelines sabotaged. The oil market is not panicking yet, because for the moment the damage is minor and the situation remains under control, but we are getting dangerously close to a military slippage.

Oil infrastructure in Middle East

Source: La Croix newspaper

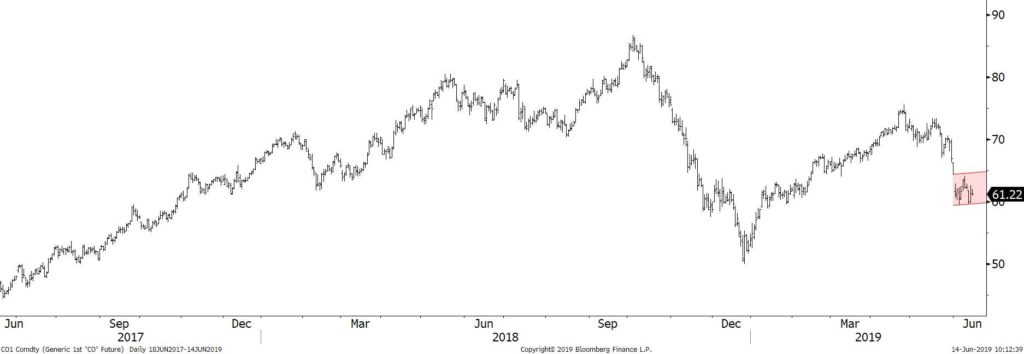

Oil prices have stopped falling, but they haven’t jumped recently despite the two tankers attacked last Thursday.

The price of Brent is stabilizing after a drop of 22% since late April

The US-China trade war, expectation of an economic slowdown and rising oil inventories in the United States are dominating, pushing down crude prices. For the second month in a row, the International Energy Agency has revised downward its estimates of growth in oil demand for 2019 and 2020.

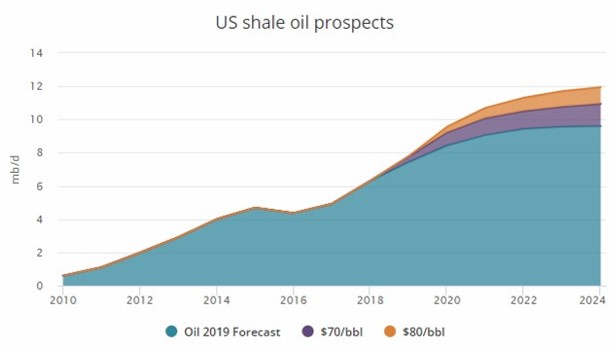

OPEC+ will have to cut further production at its June 25th meeting in Vienna, if it wants to support prices, as demand growth slows and non-OPEC production accelerates.

US shale oil production according to different estimates

Source: International Energy Agency

- Visibility is reduced on oil prices