Date: 24 September, 2020 - Blog

The Fed has unsurprisingly left its monetary policy unchanged. There was no universal agreement on this though. Kaplan and Kashkari decided to vote against the consensus. Kaplan wanted the statement to emphasize “greater policy rate flexibility beyond that point” – i.e. suggesting rates could stay low for even longer. Neel Kashkari wanted to specify they would not change rates until “core inflation has reached 2% on a sustained basis” – again, slightly more dovish. Neither of these represent hugely significant deviations from what was agreed. In any case the dot diagram of individual forecasts gives us more specific views. If inflation is not 2.0% over time, the Fed will buy everything from bonds to secondhand cars.

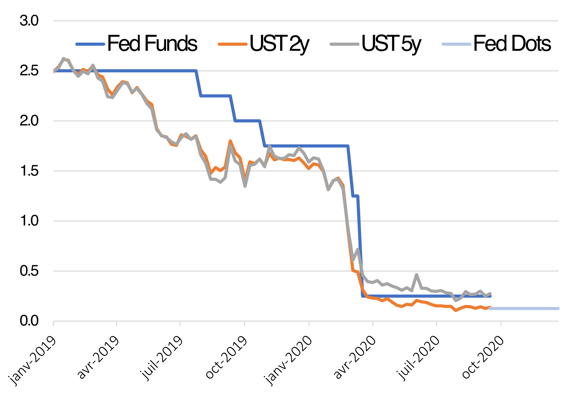

source: Bloomberg

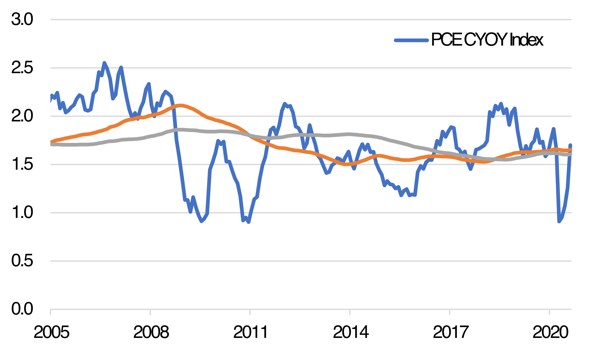

The AIT-regime remains fully in place, which means that inflation can overshoot for the 5 coming years, but who knows by how much. If we look at a 5-10-year average of the PCE price index that the Fed follows, we will argue that a 2.4.% inflation targeting regime has been introduced. Neither the FOMC statement nor Powell came any closer to clarifying this message. An average inflation targeting regime means easy policy for a long while, but it does not mean that the yield curve cannot steepen. It is, on the contrary, almost a promise that it will.

source: Bloomberg

If there were to be a break-out from this meeting, it should be in the direction of a steeper curve from the back end. The curve remains very directional with respect to data going forward. The anchor on front end rates has been extended through to 2023, which means that 2yr yields are going nowhere.

- Steeper US yield curve remains the Fed favorite trade