Date: 7 March, 2019 - Blog

High-yield bonds have led the credit market recovery so far this year.

It has gotten a boost from both the equity market rebound and the yields decline. After collapsing by 4.5% in Q4 last year, the US speculative-grade market has sharply rebounded and already soared by 6% this year.

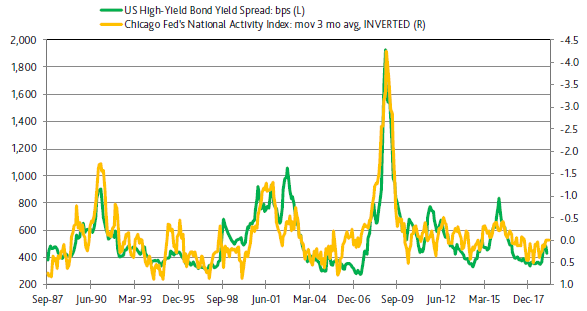

The HY spread has a strong correlation with macroeconomic indicators, equity markets, and the expected default rates. According to Moody’s, amongst all indicators, the HY spread exhibits its strongest correlation with macroeconomic indicators and more precisely with the Chicago Fed National Activity Index. The latest data points out that the HY market is correctly valued.

Source: Moody’s

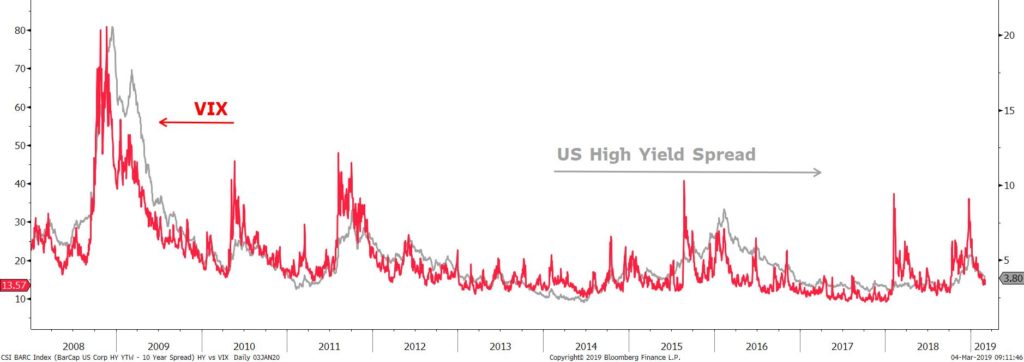

The strong correlation between the VIX and the HY underscores the importance of the equity market to corporate credit. All other things being equal, the default risk should decline as the market assigns a greater and more stable value to the corporate assets and earnings streams backing corporate debt. A healthy equity market enhances systemic liquidity. Financially stressed companies can more easily raise cash via assets sales when the VIX is low and PERs are high. Given the actual VIX level (below 15), the HY market still has some potential.

The lower the expected default risk, the greater the company market value… Moody’s forecasts that the HY annual default rate will dip to 2.4% by January 2020 from 2.6% in January 2019. It supports a stable HY spread.

Over the last year, and regardless of the challenging and volatile landscape, fundamentals have improved. Net leverage has declined to 4.2x from 4.8x, and interest coverage increased to 4.4x from 3.5x. While earnings are likely to dip in Q1 2019, they are expected to be stable this year and into 2020. The HY valuation receives support from solid fundamentals and expectations of corporate earnings growth into 2020.

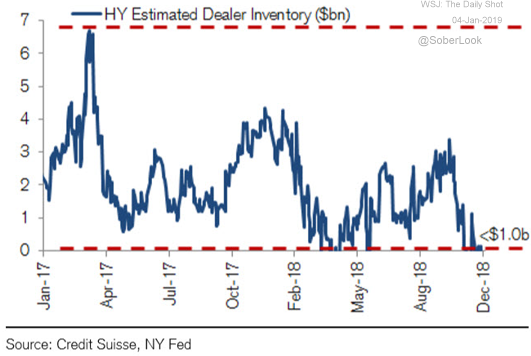

Even if the global market liquidity remains poor – as the regulatory constraints are still refraining dealers and investment banks to increase their inventories – new issues demand is improving.

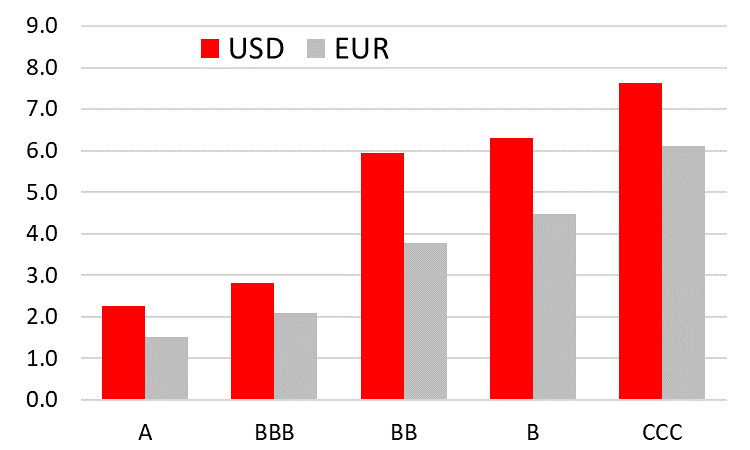

The HY is still yielding at 6.5% in the US and 4.0% in Europe, i.e. an average excess spread of 400bps, for an average duration of 3.5 years. This must then be compared with an average yield of 4.0% in the US and 1.1% in the European credit markets, and a spread of 125bps, and a 2.7% yield on the US government bond market. Moreover, the average maturity of those segments is around 6 years.

Source: Credit Suisse

- After a strong start, the credit market should stabilize

- The main contributor to the annual performance going forward should be the carry

- Stay overweight High Yield