Date: 21 November, 2018 - Blog

Draghi delivered a positive economic outlook. While some surveys have been somewhat weaker, the incoming data still suggest a continuation of the euro area expansion. And inflation is still expected to converge close to the ECB 2% target. Despite some downside risks (protectionism, emerging market and market volatility), the growth outlook remains broadly balanced.

Given these risks, why is the ECB sticking to its plan? First, some of the Q3 factors might be temporary. And more importantly, the ECB wants to end its net asset purchases without any slightest doubt. The ECB will keep rates unchanged at least through the next summer and maintain the balance sheet size by reinvesting maturing bonds for an extended period after December. Therefore, the ECB will focus more on the forward guidance. Of course, if the outlook worsens, the ECB could signal a longer period of unchanged rates and reinvestments.

Lately, a lot of attention has been given to reinvestment rules and alternative tools:

- The ECB will shortly review its capital key, a measure that determines how its €2.6trn QE program will be reinvested. Excepted capital key changes will be marginal and mainly at the benefit of Germany (+0.9%) and at the expense of Italy and Spain. Italian bonds purchase should drop by 0.75bn and German ones climb by 1bn per year. These numbers are rather limited compared to 512bn and 360bn of German and Italian bonds held by the ECB and to the 2019 expected reinvestments of 52bn and 32bn respectively.

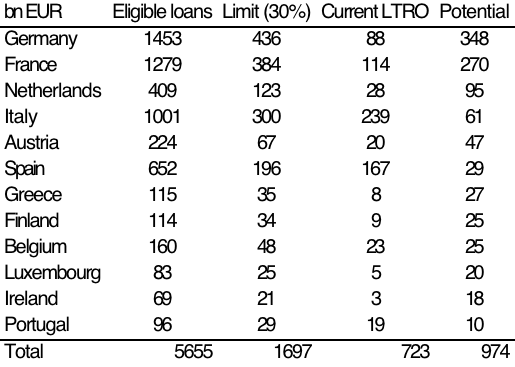

- Targeted longer-term refinancing operations (TLTRO) – a measure that supports more banks and loan growth – have made a comeback. During the last ECB press conference, Draghi mentioned it without giving details, several ECB members did the same since then. Another TLTRO round looks likely given the regulatory requirements coming in July 2019 and the fragility/dependency of southern European banks to liquidity. Expectations of another round are legitimate.

Source: ECB

While the ECB has not discussed in detail yet, it would be a politically easy measure to deploy. The largest users were Italy and Spain. Since then, the Spanish banking sector has recovered. However, the Italian one remains fragile. It is still uneasy to assess the impacts of these operations on economic growth.

It is not a bazooka like the QE is, but it is a solid tool that supports loan growth. Former operations have helped to transfer lower rates to the private sector. Lending rates to households and corporates have declined by 200pbs after the 2014 first TLTRO launch. So, it had a clear positive impact.

- ECB on hold until next summer is confirmed, in order to favor a reflationary process

- No tsunami expected from the ECB capital key rebalancing

- Other tools, that support consumer and banks, should be preferred