Date: 2 March, 2023 - Blog

Investors are pricing the ECB will raise rates to all-time highs of 3.75% by September this year, up from the current 2.5%. This would match the 2001 peak just after its launch. Despite a strengthening positive correlation with rates though, the EUR remains under pressure.

Better-than-expected economic data has been the main theme in February, catching markets off guard and fueling optimism that recession may still be delayed. However, strong consumer spending and private sector activity in general is fanning fears that inflation could prove tougher to rein in.

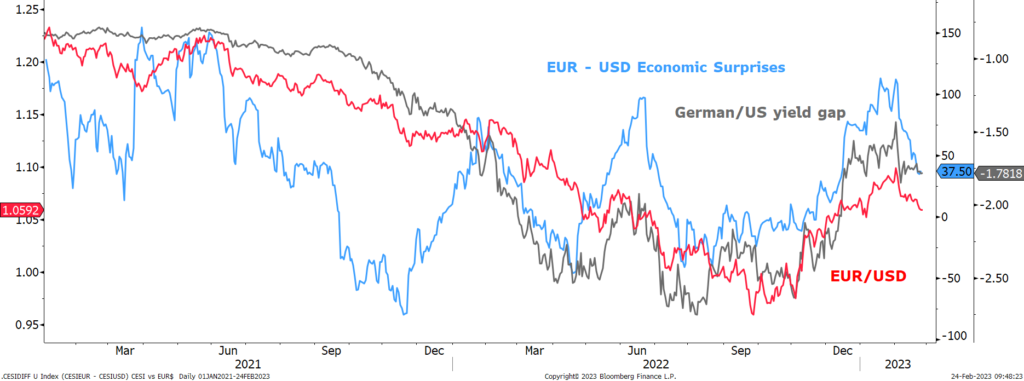

EUR/USD main drivers

Earlier last week, after buoyant service-sector activity indicators, the German 2-year yield hit a 14-year high just shy of 3%. Sentiment improved in Germany as the IFO increased once again in February and to levels last seen in summer of 2022. However, the current assessment component dropped for the 2nd month in a row and remains weak, keeping recession fears alive. And the third estimate of German GDP growth in Q4 2022 shows that celebrating resilience was a bit premature. A technical recession is in the making.

Usually this better than expected context should support the currency, but it is the USD that has outperformed the most amidst the subsequent wave of risk aversion to hit financial markets because of the “higher for longer” rate narrative.

- A breakdown of the 1.06 floor opens the door to a return towards 1.04-1.05