Date: 25 June, 2018 - Blog

Daimler and BMW could be the most affected by the trade war. Taking advantage of globalization, Daimler and BMW built important production lines in the United States, respectively in Alabama and South Carolina, for exports to China. The two German manufacturers would be penalized by a rise in Chinese import tariffs of 40%. For Ford and GM, the Chinese market is very important as well, but the 2 Americans produce locally.

Adding to the complexity of the repercussions of the trade war, Daimler’s and BMW’s competitors, Audi and Porsche, would benefit because they export cars to China, but from Europe.

Moreover, Daimler has already announced a warning on its results. This trade war could encourage German manufacturers to locate their production in China, and thus put at risk jobs in the United States. The Chinese auto sector is not at risk, as it exports only 0.2% of its production to the United States. The final result of Donald Trump’s trade war could ultimately be the opposite of the intention: the end of multilateralism could spur industry to produce locally for the local market only.

This is the story of the one’s own petard : Daimler and BMW contribute to the commercial surplus of the US automotive sector with China.

VW, GM and Ford could be affected by US import taxes on Mexican imports, as these 3 manufacturers are producing in Mexico for the US market. But American consumers would obviously be affected as well.

Toyota and Honda would be hard hit by US import taxes on their cars produced in Canada. But Canada would not spare GM and FCA exporting to Canada.

In short, the trade war is going to be complex for the automotive sector and potentially painful for US, Canadian and Mexican consumers as European and Chinese consumers have the alternative of buying local brands.

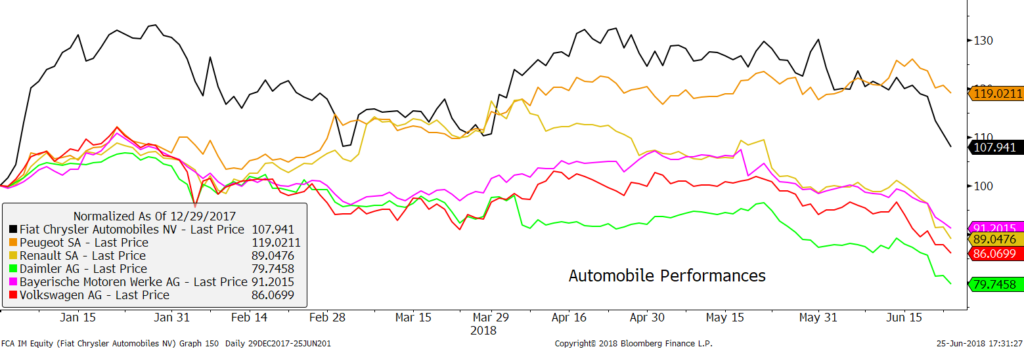

Since the beginning of the year, Peugeot seems the most immune to a trade war, since the share price progresses by 20%. FCA also seemed so, but the stock price has recently come down, as the Jeep, RAM and Chrysler brands would be affected by a US, Canada, Mexico trade war. But Peugeot and FCA are supported by restructuring stories. German builders are the most penalized.

If Chinese manufacturers are less affected by the trade war, because they export little, the stock market performances were bad in 2018, -25% on average, of which -38% for Guangzhou and -31% for Brilliance, due to a slowdown in sales, intense domestic competition and significant costs for the electrification of the car fleet.

- Underweight the automotive sector

- We stay positive on FCA (support at €16, target €24) and Ferrari (support at €106, target €150)