Date: 4 July, 2019 - Blog

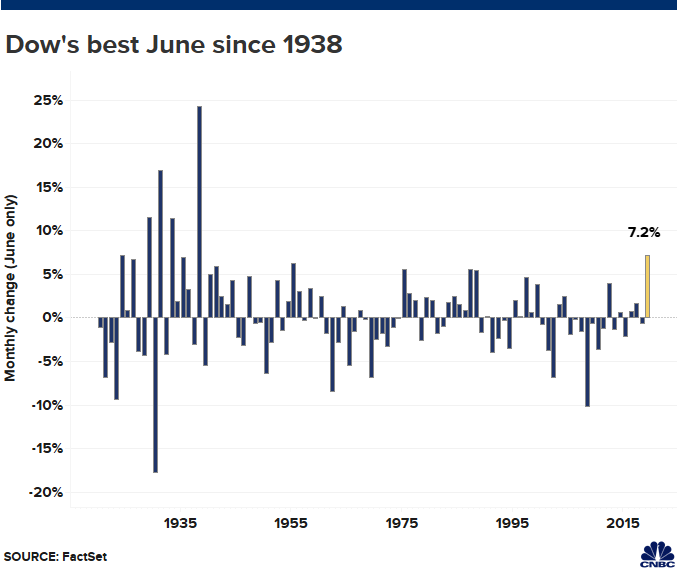

For the Dow Jones, the month of June 2019 is the best month of June since 1938 !

In May, stock market indices in developed countries declined by 7% on average. The US semiconductor index fell by more than 17%. We feared a difficult June. It has not happened. There has been a strong rebound in stock markets to return to early May levels. The semiconductor index recovered 70% of its May losses.

January 2019 was one of the best months for a January on a historical basis for the S&P 500, and the first half of 2019 (+17.4%) is the best first half for 22 years. For the Dow Jones, the month of June 2019 is the best month of June since 1938 !

Dow Jones. Best month of June since 1938

The strong support of central banks is the main explanation. The month of July could be another positive month thanks to the relaunch of trade talks between the United States and China, as well as temporary and limited easing (yet to be validated by the US Administration) on the sale of US IT products to Huawei.

Yet, there are many reasons to bet against this long bull market, more than 10 years old. Investors lack conviction (or are lost) since the beginning of the year: the outflows from equity funds were $ 138.5 billion (source: Bank of America / EPFR Global), of which $ 41 billion for the US and $ 71 billion for Europe.

The resilience of equities could prefigure that the economic cycle is not so deteriorated: domestic economies are resilient, while the international economy suffers from Donald Trump’s wars; an agreement between the United States and China could boost investors’ confidence in the international economy. Another positive point is the relative attractiveness of equities’ valuation vis-à-vis bonds.

- The MSCI World and the S&P 500 are very close to a technical breakout

- The semiconductor segment could continue its rally thanks to Donald Trump’s (ambiguous) statements