Date: 25 February, 2021 - Blog

Elon Musk (EM), the flamboyant entrepreneur and sulfurous pot smoker leaves no one indifferent. Formidable innovator, he regularly transgresses limits and cultivates difficult relations with the establishment and the banking world. Regularly lectured by the SEC for his improbable tweets and sometimes on the verge of break-up, he is now back in the spotlight, boldly and… differently with his massive support to Bitcoin, the star of cryptocurrencies.

Iconoclastic visionary or megalomaniacal adventurer?

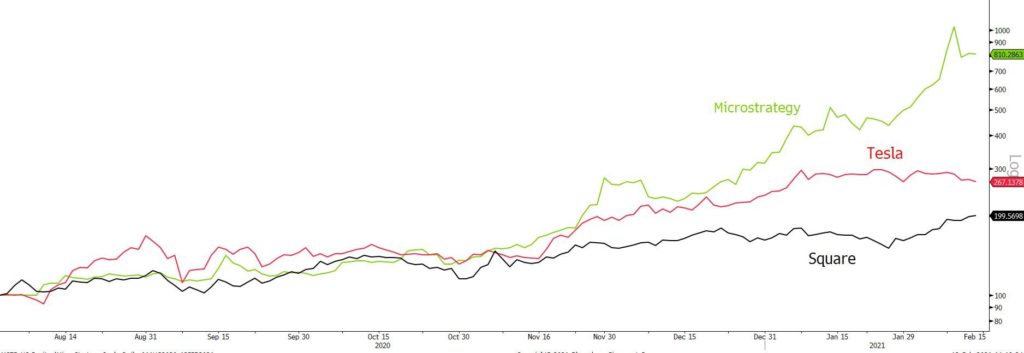

In Q3 2020, Microstrategy, a company listed on Nasdaq since 1998 and active in ¨business software intelligence¨, bought $450m worth of Bitcoin, which represented about 100% of its cash. Then, Square Inc, a fintech (transaction processing services), had also invested $50m in the crypto-asset last October. Both transactions went relatively unnoticed. However, they clearly represented a new paradigm in two respects: they were validated by their auditors and approved by the stock exchange authorities, the SEC.

So far, so good for crypto-purchasing corporate

Source: Bloomberg

EM’s controversial – even divisive – personality and the size of the recent transaction – $1.5bn of Bitcoin – belong to a different category. From now on Tesla, a company recently included in the very select club of the S&P500, not only embraces cryptocurrency as a store of value, but also as a future means of payment for its customers.

EM ambitions to give respectability and impose BTC

His undeniable audacity is a gamble in several respects

Non-benign stakes for Tesla

First, the volatility of BTC is a potential source of instability for the company as, a) it represents an exceptionally large amount, even more so for a company which traditionally burns cash and b) the – low – liquidity of the BTC market would make it difficult to reverse it (sell) in case of need.

Tesla intends to treat its crypto holdings as an intangible asset with long-term value, like goodwill. Therefore, according to US accounting standards, it will be obliged to regularly mark it to market. As a logical consequence, BTC evolution would impact profits. But a positive effect would only be accounted for when the company actually sells this holding (realized profit). Things remain fluid from an accounting perspective so far. According to tax experts, US authorities are contemplating new rules on how companies should recognize crypto-like investments.

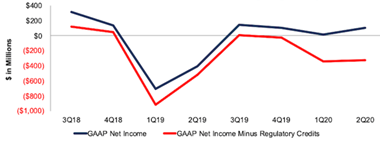

Second, a large exposure to crypto-assets by Tesla may ultimately challenge a company’s major source of revenues: carbon credit. Indeed, Tesla’s depends significantly on selling regulatory credits to other – car manufacturing – companies. Ultimately, some argue that Tesla’s status of a clean car manufacturer could face scrutiny because of BTC. Incidentally, over the medium-term, mainstream automotive companies will scale up their zero-emission vehicle sales, and thereby reduce the need to buy credits from Tesla…

Tesla profits are highly dependent on carbon credits

Third, Tesla is modifying its image. The company may indeed be delicate with a fringe of his shareholders and clients, i.e. those having an environmental sensitivity. Indeed, Bitcoin mining is a nightmare when it comes to its energy consumption! It therefore puts at risk Musk’s declared intention to build a ¨new style of corporate conglomerate dedicated to tackling climate change¨. More, he runs the risk of alienating the institutional flows that require ESG criteria.

Musk may succeed to impose BTC as a new – standard – method of payment…

… but he could as well trigger negative regulators / clients / shareholders reactions

- Musk engages a crusade in favor of cryptocurrency

- In doing so, he definitely raises the risk profile of Tesla