Date: 21 February, 2019 - Blog

Airbus announced the end of the A380 program, after 12 years of flight. The industry no longer wants big aircrafts but smaller and more efficient ones. In the 1990s, unlike Boeing, Airbus bet on a global network of some big hubs, from where passengers would take smaller aircrafts for smaller airports. A bad bet. For Airbus, the scheme was point to hub to point. Finally, passengers preferred to travel point-to-point, the strategy adopted by Boeing.

The cancellation of the Emirates order gave the end clap. Problems of profitability, with engines, problems of access in airports. Airlines are reluctant to purchase quad-engines carrying more than 500 passengers, preferring efficiency by using full seating capacity.

It is a relief. And better visibility for investors. The impact will be limited and all employees of A380 program will be relocated to other programs, with orders being large and representing 8 years of production. During the life of the A380, the Airbus group generated profits despite A380 charges. The development and launch costs of the A380 were € 18 billion for 250 aircrafts delivered. The A380 program has been well managed because it was profitable since 2015.

Boeing preferred to develop the 787 Dreamliner, a dual-engine aircraft with the same range that the A380, but more flexible in terms of roads. Finally, the airline company have abandoned the A380 in favor of the A350 and A330.

The prospects remain bright for the 2 aircraft manufacturers which are in a duopoly situation. They strengthened their positions: in 2017, Airbus purchased Bombardier’s short-medium-haul aircraft program, mainly to gain market share in the United States, and in 2018 Boeing purchased Embraer’s commercial aircraft (regional aircraft). The goal of the 2 aircraft manufacturers is to limit as much as possible the emergence of a future competition, in particular Chinese one. They will rely on the digital and the new Airbus weapon is called Skywise, a gigantic big data integrating airlines, commercial flights and computer systems that will predict and reduce the downtime of aircrafts through predictive maintenance.

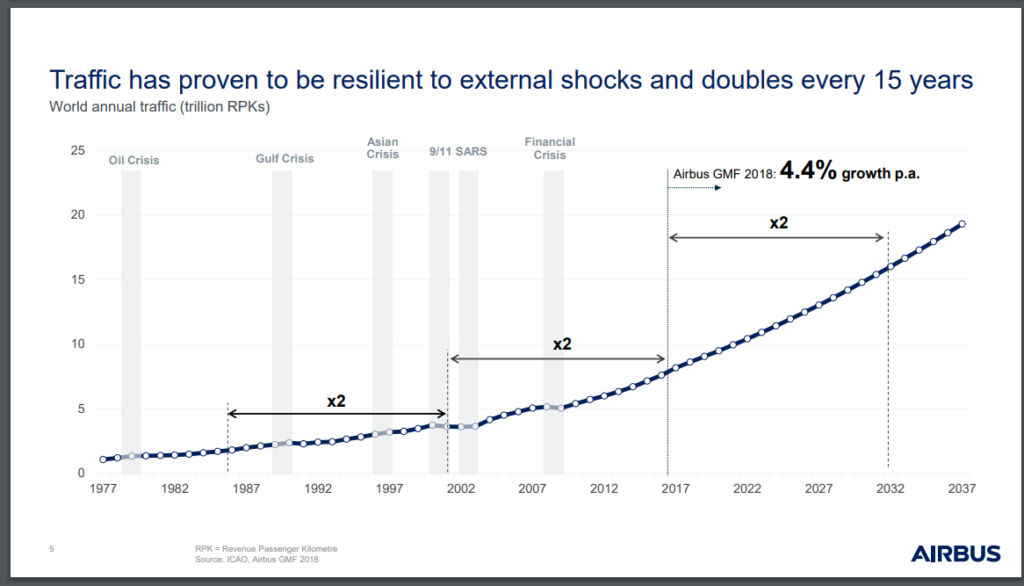

The visibility of the commercial aviation sector is good and resilient to external shocks. Passenger traffic doubles every 15 years, i.e. +4.4% per year.

The development of emerging countries and its middle class will result in a need for 40’000 new aircrafts within 20 years, or 2’000 additional aircrafts per year. Today, there are around 22’000 commercial aircrafts in the world and the fleet is estimated at 48’000 aircrafts in 2037. The 2019-2037 market will represent approximately $6’000 billion of sales. By 2037, sales breakdown in units: 75% single-aisles (mainly A319-320 and B737), 20% twin-aisles/wide body and 5% regional aircraft; and in dollars: 55% single-aisle, 40% twin-aisles/wide body and 5% regional aircraft/freighters.

In commercial aviation, Airbus and Boeing are pretty close with 800 aircraft deliveries each in 2018. They are equitably sharing the global market for commercial aviation. In terms of group sales, Boeing with $100 billion is larger than Airbus ($62 billion), because the military activity is more important at Boeing.

We are therefore positive on the sector in the medium-long term.

- Valuations : Airbus € 135 and Boeing $ 470