Date: 2 October, 2020 - Blog

Two and a half years after Bloomberg Barclays announced that China would be included in their Global Aggregate Index, FTSE Russell has announced that Chinese Government Bonds will make it into the World Government Bond Indices (WGBI) starting October 2021. This is still subject to final confirmation, but there is no reason for inclusion not to go ahead. The Chinese authorities have implemented significant changes to address the concerns of foreign investors. They have most recently extended bond trading hours and allowed access to onshore hedging tools, such as forwards and interest rate swaps. The 12-month lead-time is like the lead-time provided by Bloomberg Barclays. It is reasonable to assume that China will carry a weight of around 6% like it will be in the Global Aggregate Index.

According to FTSE Russell, WGBI is tracked by around $1 trn of passive funds and $1-3 trn of active funds. So, if we consider only $2 trn of funds tracking the WGBI, a 6% weight would imply $120bn of inflows to the onshore China government bond market. This would translate into $10bn of inflows per month over the coming year.

Source: Bloomberg

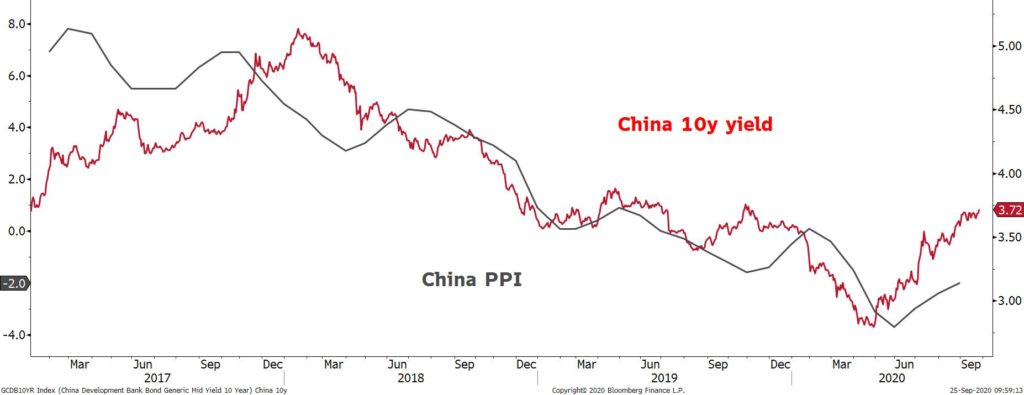

Overall, it is constructive for the Chinese bond market, but will not cause a material fall in yields. The Chinese 10-year will range-trade around 3.0% in the coming months. The cyclical upturn in the Chinese economy and the rise in PPI inflation should drive the yield higher. This should be compensated by the international demand. The wide yield spread between CGB and UST is set to persist, and with expectations that inflows will continue, this will be supportive of the yuan. The downtrend in USD/CNY is still intact after correcting form oversold levels.

USD/CNY

Source: Bloomberg

- Chinese government bonds stay a source of diversification in the fixed income space

- The Yuan remains the only attractive carry trade amongst EM countries

By Jerome Baillaud