Date: 20 September, 2018 - Blog

After hiking rates in August, the Bank of England kept its policy stance unchanged, as widely expected. After a series of dissenting votes at previous meetings, the MPC voted unanimously. The statement reads largely unchanged. More importantly, the committee’s language on Brexit looks more alarming.

Since the August meeting, there have been signs of greater uncertainty around the withdrawal process, especially in financial markets. Any future increases in rates are likely to be gradual and limited. However, the economic outlook could be significantly influenced by the households, businesses and financial markets responses to EU withdrawal developments.

So, Brexit is the main challenge in achieving the 2.0% inflation target. This also means that the BoE has a limited appetite for a weaker GBP, as any further weakness will drive to an inflation target overshooting.

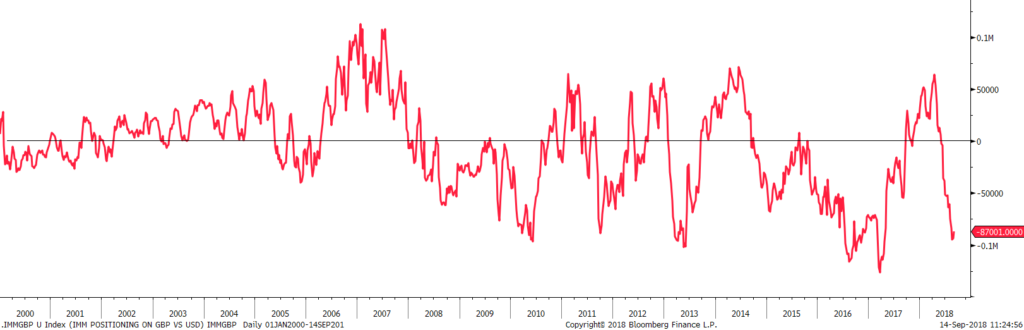

GBP speculative positioning

With Governor Mark Carney and its Deputy Cunliffe have extended their terms to see out of the period of uncertainty around Brexit. This issue will remain key to the BoE outlook. We do not expect any rate hike before the UK formally leaves the EU i.e. in June 2019. The GBP will remain very volatile and sensitive to Brexit news in coming months. The market is already well positioned for a hard Brexit or an exit without agreement.

- We turn back neutral on the GBP