Date: 19 September, 2019 - Blog

The intuitive response to more ECB easing should be a lower currency. However, there are factors that will limit any downside move for the EUR. First, the tiering system has been put in place to reduce the currency impact of lower rates. Furthermore, it suggests that rates are close to their lower limit.

Then, with lower US yields since the beginning of the year, the yield spread is less supportive. Looking at the EUR/USD vs. the 2- and 10-year yield spreads, it has diverged. Until now absolute rates levels have driven the currency. It also suggests that the EUR/USD is simply undervalued based on the rate spreads. And at the very least, the EUR has discounted a too aggressive ECB easing. The main near-term risks comes from Germany falling into a recession and the Fed.

Source : Heravest SA

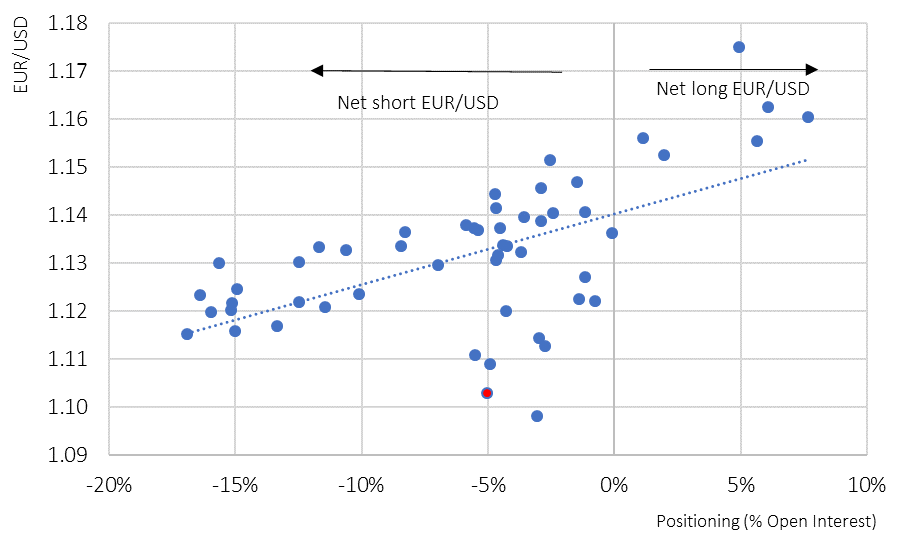

Looking at the speculative positioning, investors are net short EUR/USD, but not excessively. Given the ECB tone, a short covering is underway.

Speculative positioning vs. EUR/USD

- Stay long EUR vs. USD